Former Warner Music CEO Edgar Bronfman Jr. Teams With Bain Capital for $2 Billion Paramount Bid

Edgar Bronfman Jr., former Warner Music CEO, has partnered with Bain Capital to bid $2 billion for Paramount Global, joining a competitive race for the media giant's acquisition.

National Amusements Inc. (NAI), which controls 77% of Paramount's voting shares and is owned by Shari Redstone, is currently exploring options to sell its majority stake. Paramount's portfolio includes CBS, various movie studios, and networks like Comedy Central, Nickelodeon, and MTV.

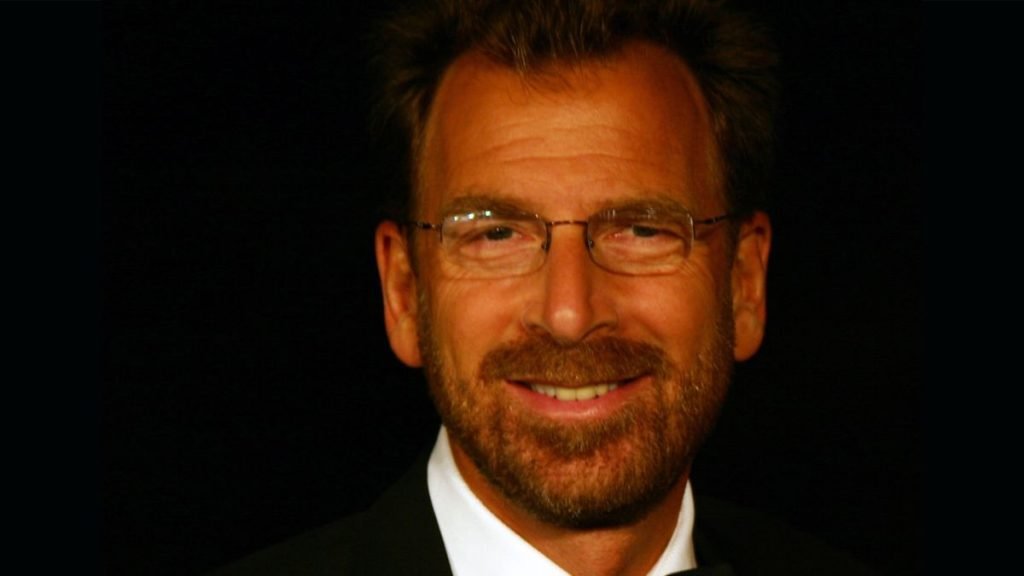

Edgar Bronfman Jr. smiles at camera

Photo Credit: Christopher Peterson / CC by 3.0

Multiple parties have shown interest in the acquisition:

- Hollywood producer Steven Paul is preparing a $3 billion offer

- Skydance Media, backed by RedBird Capital and KKR, is negotiating a potential merger

- Sony Pictures and Apollo Global Management expressed interest, though Sony has since withdrawn

The increased interest follows S&P Global's March 2024 decision to downgrade Paramount's debt rating to junk status. The company currently carries $14.6 billion in long-term debt as of end-2023, with S&P Global noting that Paramount must "substantially improve streaming losses over the next two years" to avoid further downgrades.

If Skydance's deal proceeds, they would acquire two-thirds of Paramount's shares for approximately $2 billion, with current Class B shareholders receiving $15 per share. The company would remain publicly traded.

Bronfman brings significant media industry experience, having served as Warner Music Group's chairman and CEO from 2004 to 2012, and previously as Seagram's CEO before its sale to Vivendi in 2000. He currently serves as executive chairman of Fubo, a sports-focused streaming service.

Taylor Swift performing on concert stage

Apple logo against gray backdrop

Related Articles

Diageo Considers Selling Cîroc Vodka Following Split with Diddy